Revenue Recognition Chapter 18 Intermediate Accounting 12 th

Generally, certain aspects of the percentage-of-completion method for financial statements differ from the required tax method and will continue to diverge from the tax rules under ASU No. 2014-09. If the taxpayer is currently following the financial accounting method to recognize revenue and that method is not permissible for tax purposes, it.

Percentage of Completion Method AwesomeFinTech Blog

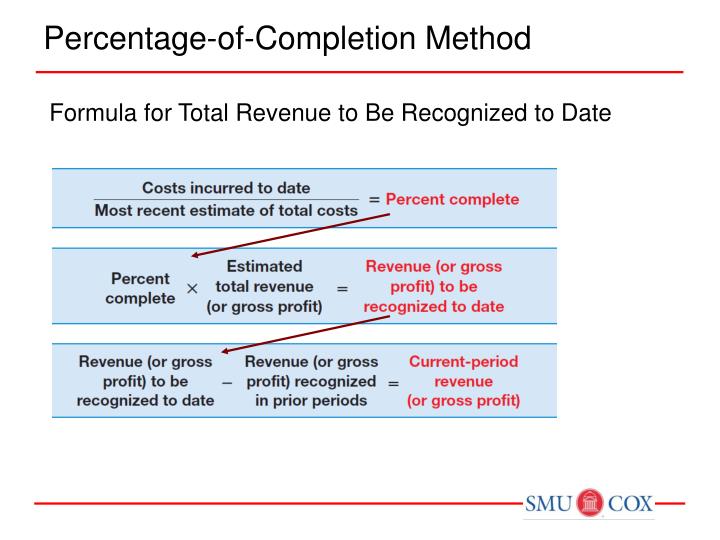

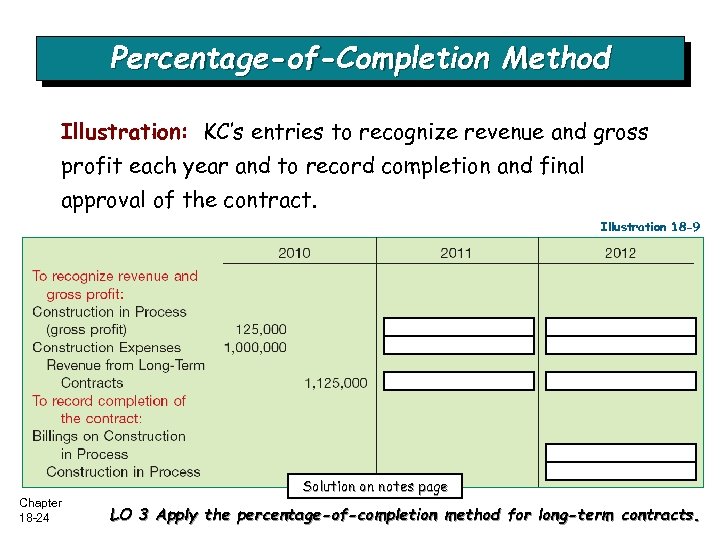

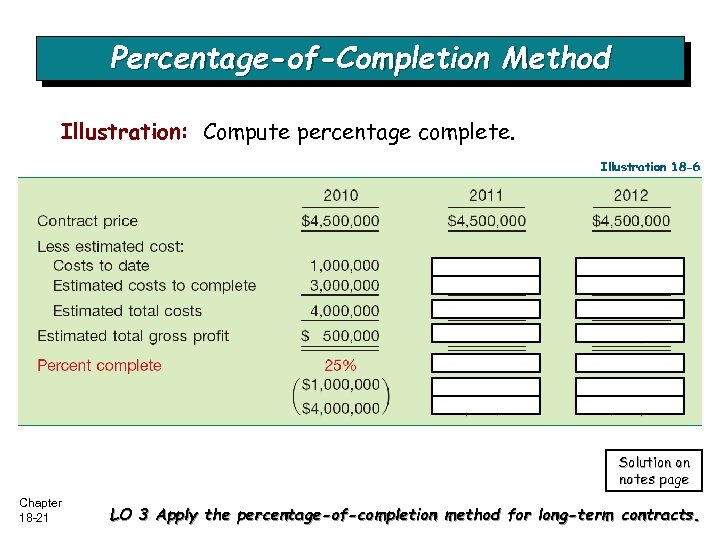

The percentage of completion method is used by a business to calculate the amount of revenue and therefore income to recognize on a long term project.. Having calculated the percentage of completion, the next step is to apply this percentage to the estimated total revenue from the project. Revenue Recognition. Suppose in the above example.

1.Apply the revenue recognition principle. 2.Describe accounting issues involved with revenue

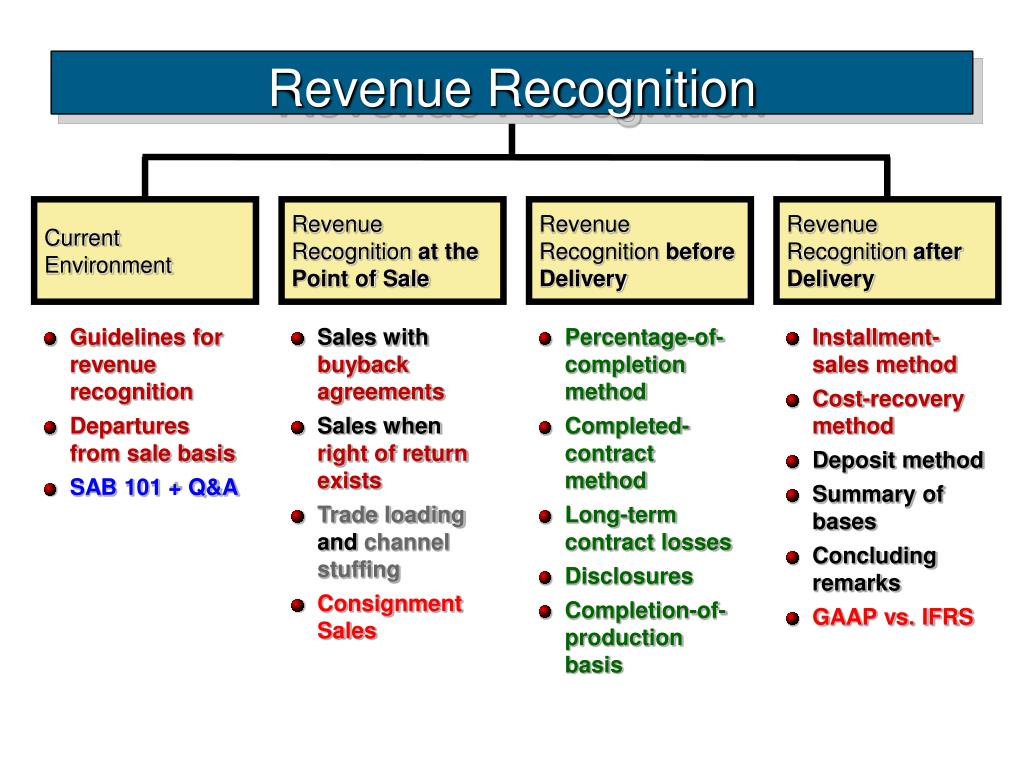

Percentage of completion (PoC) is an accounting method of work-in-progress evaluation, for recording long-term contracts. GAAP allows another method of revenue recognition for long-term construction contracts, the completed-contract method .

How to Easily Create Percentage of Completion Calculations & Adjustments Build Your Numbers

This video discusses the Percentage-of-Completion Method for recognizing revenue on long-term contracts in accounting. The video provides a comprehensive ex.

RealTime Revenue and Recognition Using of Completion

Under this method, revenue and expenses are recorded upon completion of the contract terms. Percentage-of-completion. This method ties revenue recognition to the incurrence of job costs. If "sufficiently dependable" estimates can be made, companies must use the latter, more-complicated method, under U.S. Generally Accepted Accounting.

PPT CH 05 Part A Revenue Recognition PowerPoint Presentation, free download ID497495

This is an ideal recognition method for large-dollar items, such as real estate, machinery, and consumer appliances. Percentage of Completion Method. The percentage of completion method involves, as the name implies, the ongoing recognition of revenue and profits related to longer-term projects. By doing so, the seller can recognize some gain.

PPT Revenue Recognition PowerPoint Presentation, free download ID5575646

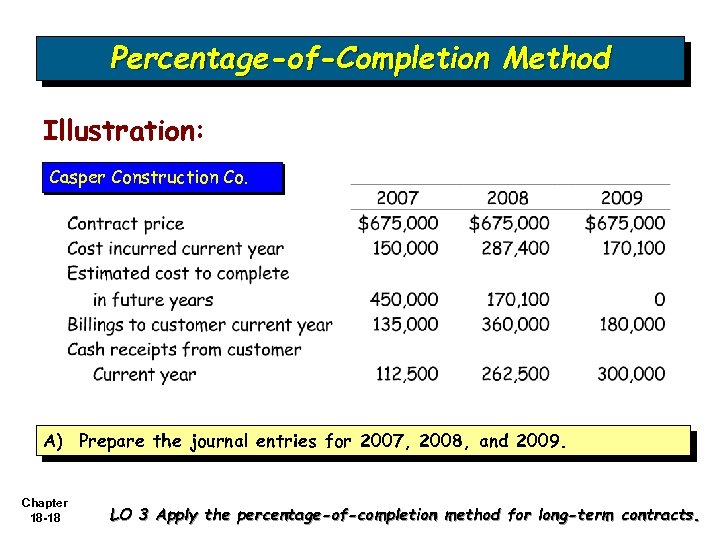

If the estimated costs of a long-term project are $50,000 and you have incurred $10,000 in the current period, then the percentage of completion is calculated as follows: Percentage Completion = 10,000/50,000. % Completion = 20%. If the estimated revenue of the project is $80,000, the revenue recognized is: Revenue Recognized = 20% x 80,000.

Revenue Recognition Chapter 18 Intermediate Accounting 12 th

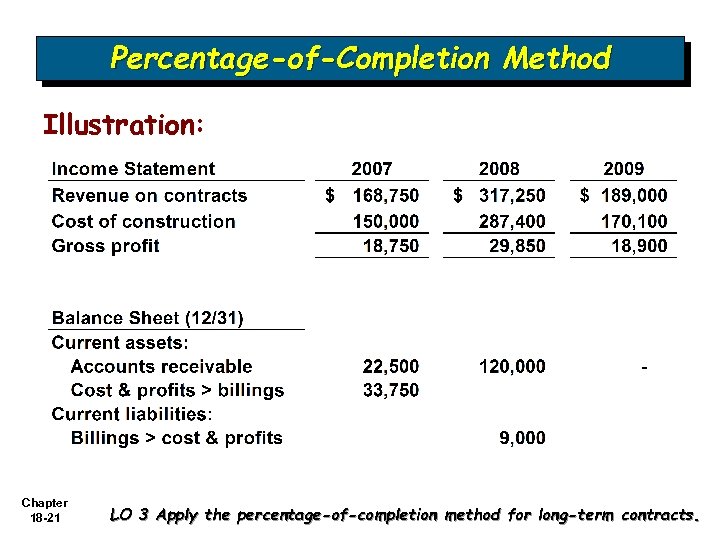

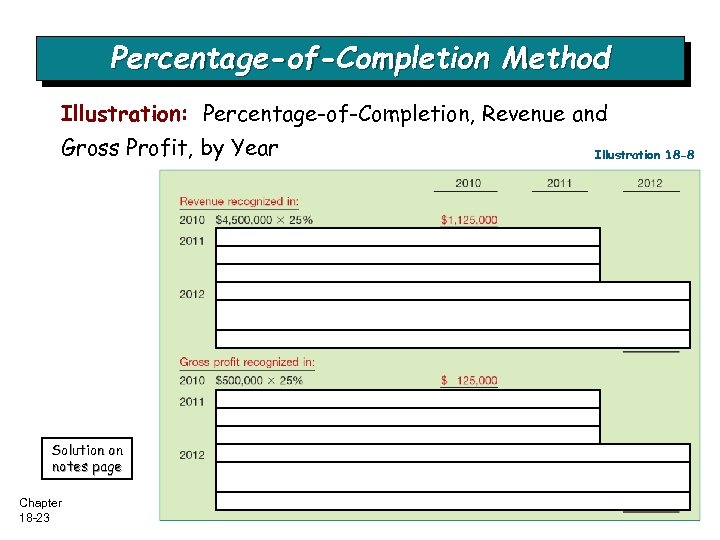

The percentage of completion method is a revenue recognition accounting concept that evaluates how to realize revenue periodically over a long-term project or contract. Revenue, expenses, and gross profit are recognized each period based on the percentage of work completed or costs incurred.

Percentage Of Completion Method Formula & Example Advantages

As of the end of Year 1, Seller has completed 80 percent of the contract (i.e., has incurred $60 of cost) and for federal income tax purposes recognizes $80 of revenue and $60 of costs. However, Seller has only billed $50 under the contract. In Year 2, before incurring any additional costs on the contract, Seller enters into a fully taxable.

PPT Chapter 18 REVENUE RECOGNITION Sommers Intermediate I PowerPoint Presentation ID1644995

The percentage of completion method is a way of recognizing income in stages over the life of a long-term construction project.. If you used a different revenue recognition method in a prior year, you'll need to file Form 3115 with your tax return and file a second copy with the IRS address provided on the Form 3115 instructions.

Everything You Need to Know About the Method (PoC)

Revenue recognition for long-term construction contracts has traditionally been reported using the percentage of completion method. ASC 606 changes the way in which revenue is recognized by redefining the activities that determine the completion of performance obligations as required by the contract. It follows a five-step revenue recognition.

Percentage of Completion Method (Financial Accounting) YouTube

Percentage Of Completion Method: The percentage of completion method is an accounting method in which the revenues and expenses of long-term contracts are recognized as a percentage of the work.

Chapter 18 1 CHAPTER 18 REVENUE RECOGNITION

Percent complete = Total costs to date ÷ total estimated costs. The total percentage of costs that have been incurred is the percentage of completion for the project. This percentage is multiplied by the total contract amount to determine the revenue to recognize during the period. Revenue recognized = Percent complete x contract amount.

Percentage of Completion Method of Revenue Recognition YouTube

The percentage of completion method of accounting is a procedure for recognizing the revenue and expenses related to projects spanning multiple accounting periods. Industries like real estate's construction, or manufacturing are some of the examples of such projects. The recognition of revenue and expense are to the extent of project completion.

Chapter 18 1 CHAPTER 18 REVENUE RECOGNITION

Solution: Under the survey method the engineers have provided their judgment of the percentage of work completed and it is 40%. Based on costs incurred to date and total costs the percentage of completion comes out to be: Percentage of work completed = $50 million ÷ ($50 million + $110 million) = 31.25%. Total costs include costs incurred to.

Chapter 18 1 CHAPTER 18 REVENUE RECOGNITION

There are many types of revenue recognition that are allowed under the Generally Accepted Accounting Principles (GAAP), and they all have different benefits and limitations depending on how you do business. The percentage-of-completion method (PoC) is a common revenue recognition method for companies that deal in long-term contracts.

.